Executive Summary

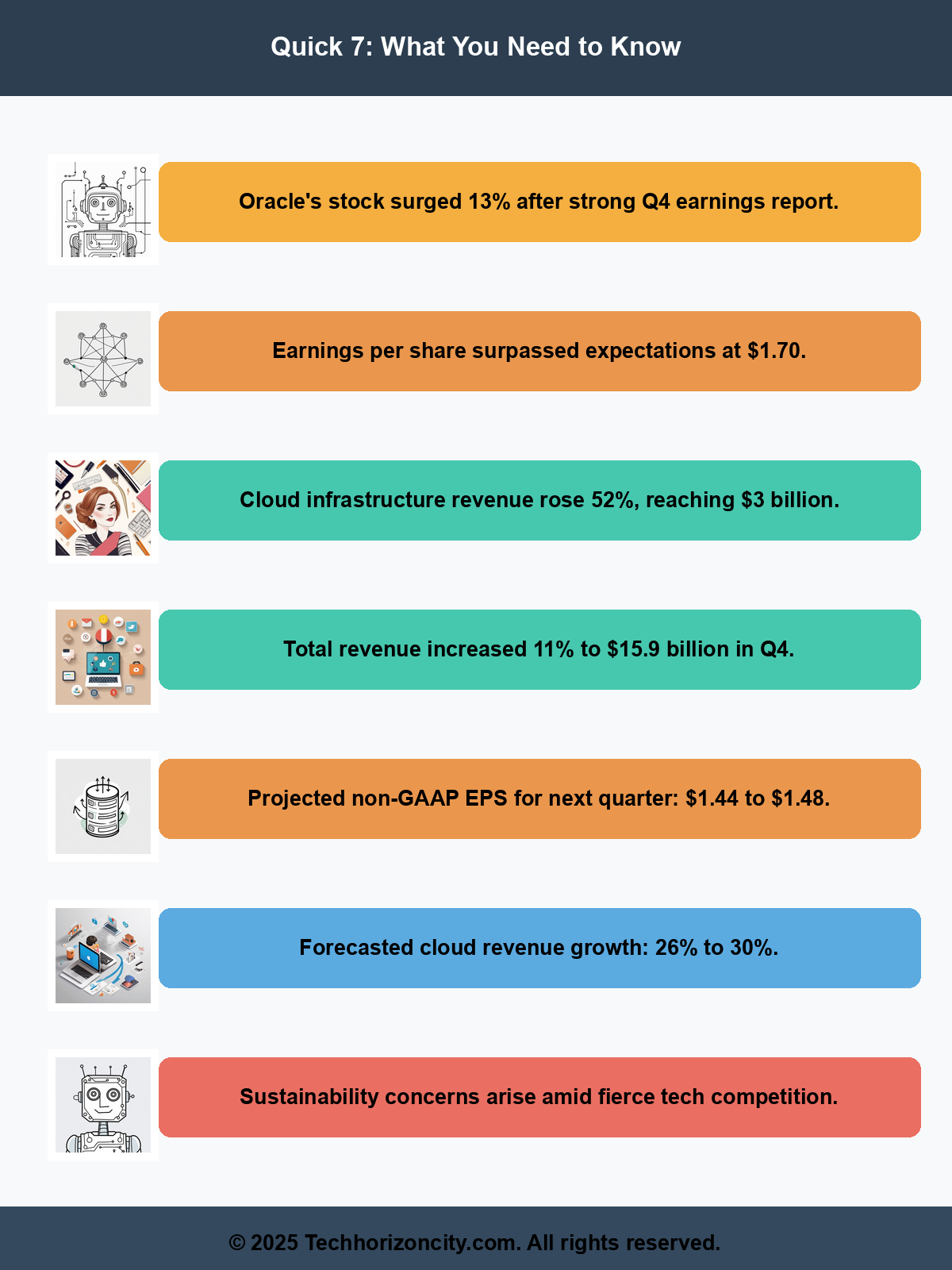

Oracle Corporation has made headlines recently, not just for its impressive earnings report but also for the subsequent surge in its stock price. With shares rising 13% post-Q4 earnings, the tech giant showcased a strong earnings per share (EPS) of $1.70, surpassing analyst expectations. Coupled with a noteworthy 52% increase in cloud infrastructure revenue, Oracle seems poised for robust growth in the cloud sector. However, while the numbers paint a rosy picture, the volatile market landscape raises questions about sustainability. This article delves into the implications of Oracle’s performance, its competitive positioning, and what lies ahead for the company and the tech industry at large.

Background Context

In the competitive landscape of technology and cloud computing, Oracle has positioned itself as a formidable player. Historically known for its database management systems, the company has expanded its offerings to include cloud infrastructure, a sector that has seen explosive growth in recent years. The transition of enterprises toward cloud solutions, accelerated by the global pandemic, has provided Oracle with unprecedented opportunities to capture market share.

Oracle’s recent Q4 earnings report revealed a revenue increase of 11% to $15.9 billion, exceeding analysts’ forecasts. This is a significant indicator of the company’s resilience and adaptability in a rapidly evolving market. The strong performance in cloud infrastructure, which alone saw a 52% revenue increase to $3 billion, reflects the growing demand for cloud-based services. Investors are optimistic, with Oracle’s stock climbing roughly 20% since the beginning of the year, signaling confidence in the company’s strategic direction.

For technical resources and innovative solutions, please visit EchoesOfCreationUS for specialized technical resources.

Analysis of Implications

Oracle’s ability to exceed EPS expectations not only boosts investor confidence but also positions the company favorably against its tech peers. The projected non-GAAP EPS for the upcoming quarter, estimated between $1.44 and $1.48, suggests continued profitability, a critical factor for sustaining long-term growth. Furthermore, the forecasted growth in total cloud revenue of 26% to 30% indicates that Oracle is not merely riding a wave of current demand but is strategically planning for future expansion.

However, while these results are commendable, they also invite scrutiny regarding the sustainability of such robust growth. In an industry characterized by rapid technological change and fierce competition, Oracle must continue innovating and adapting to maintain its competitive edge. The reliance on cloud solutions requires constant upgrades and enhancements, which can strain resources if not managed effectively.

Industry Impact Assessment

The gains in Oracle’s stock and performance have broader implications for the tech industry, particularly in the cloud computing space. As Oracle demonstrates its prowess in cloud infrastructure, other companies in the sector may feel pressure to enhance their offerings or face losing ground. This scenario could lead to increased investment in research and development across the board, fostering innovation but also potentially inflating competition.

Moreover, Oracle’s success highlights the growing importance of cloud services in post-pandemic business strategies. As more companies allocate substantial portions of their budgets to cloud solutions, the industry stands to benefit from a heightened focus on digital transformation. However, this shift also comes with challenges; not all companies will adapt at the same pace, leading to potential market fragmentation.

Discover exclusive offers and premium content at Active Living Offers – your gateway to enhanced productivity and lifestyle solutions.

Future Outlook

The future for Oracle appears bright, but the company must navigate a landscape marked by unpredictability. The anticipated growth in cloud revenue suggests that Oracle is likely to maintain its upward trajectory, provided it can effectively manage customer expectations and deliver consistent service improvements.

Investors should remain vigilant, as external factors, including geopolitical tensions and fluctuating oil prices, could impact the broader economic landscape. For instance, the recent spike in oil prices due to geopolitical conflicts has raised concerns regarding inflation, which may, in turn, affect consumer spending and, consequently, tech spending. As the travel industry grapples with these challenges, tech companies like Oracle may experience indirect effects through shifts in client spending priorities.

Conclusion with Key Takeaways

Oracle’s recent financial performance is a testament to its strategic focus on cloud infrastructure and innovation. With a solid earnings report and a promising outlook for growth, the company stands at a critical juncture.

Key takeaways include:

- Oracle’s share price increase reflects strong investor confidence driven by robust earnings.

- The significant growth in cloud infrastructure revenue underscores the company’s commitment to expanding its market presence.

- While the immediate future looks promising, external economic factors could introduce volatility.

- Oracle’s ongoing adaptation and innovation will be crucial in maintaining its competitive edge in a rapidly changing tech landscape.

Ultimately, while Oracle is riding a wave of success, the landscape remains dynamic, and the company’s ability to sustain its momentum will depend on strategic foresight and operational agility.

Disclaimer: This article was independently created based on publicly available information and industry analysis. While inspired by developments reported at sherwood.news, all content, analysis, and opinions expressed are original and do not reproduce copyrighted material.

For the original reporting, please visit: https://sherwood.news/markets/oracle-surges-after-earnings-blowout-as-demand-for-cloud-services-heats-up/