As technology continues to reshape the investment landscape, understanding the nuances of the Initial Public Offering (IPO) market and the banking sector’s challenges becomes imperative for developers, IT professionals, and tech learners. This comprehensive guide delves into digital product development strategies, industry trends, and essential skills needed for thriving in today’s financial ecosystem.

Key Takeaways:

- Understanding IPO dynamics is crucial for strategic investment decisions.

- Effective management of Non-Performing Assets (NPA) is a growing challenge in the banking sector.

- Familiarity with trading platforms can enhance investment analysis.

- Building skills in financial analysis can open new career opportunities.

Technical Background and Context

In recent years, the IPO market has witnessed significant growth, especially in emerging economies like India. Companies aiming for public listing utilize various digital product development strategies to align with market trends. Understanding these strategies not only aids potential investors but also equips tech professionals with insights into the financial sector’s digital transformation.

On the other hand, the banking sector faces mounting challenges, particularly concerning Non-Performing Assets (NPA). These are loans or advances that have not generated interest or principal repayments for a period, posing a risk to banks’ financial health. Addressing NPA management requires sophisticated analytical tools and a deep understanding of financial systems.

📚 Recommended Digital Learning Resources

Take your skills to the next level with these curated digital products:

Academic Calculators Bundle: GPA, Scientific, Fraction & More

Academic Calculators Bundle: GPA, Scientific, Fraction & More

ACT Test (American College Testing) Prep Flashcards Bundle: Vocabulary, Math, Grammar, and Science

Java Essentials: 100 Powerful Topics for Fast-Track Learning | PDF Download

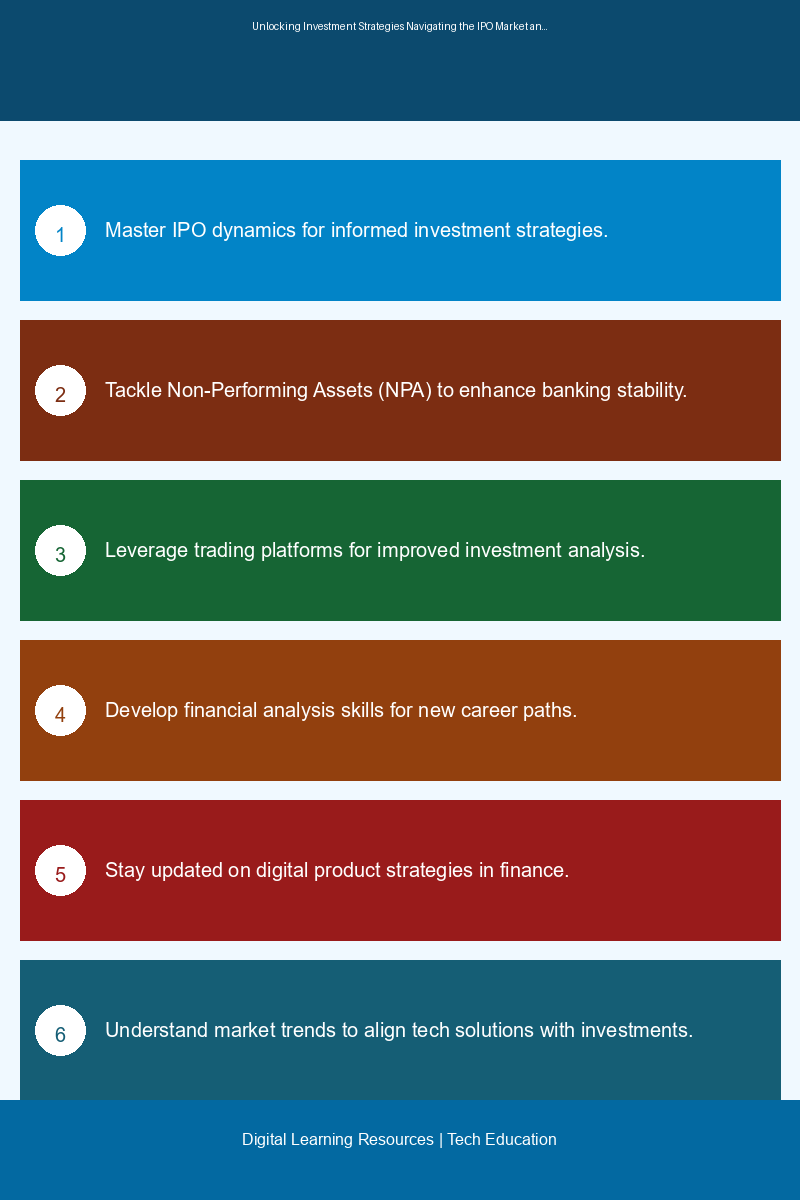

📊 Key Learning Points Infographic

Visual summary of key concepts and actionable insights

Leonardo.Ai API Mastery: Python Automation Guide (PDF + Code + HTML

Leonardo.Ai API Mastery: Python Automation Guide (PDF + Code + HTML

100 Python Projects eBook: Learn Coding (PDF Download)

JavaScript for Web Development eBook | Learn to Build Interactive Websites

HSPT Vocabulary Flashcards: 1300+ Printable Study Cards + ANKI (PDF)

HSPT Vocabulary Flashcards: 1300+ Printable Study Cards + ANKI (PDF)

Practical Applications and Use Cases

For tech professionals, the intersection of programming and finance presents unique opportunities. Here are some practical applications:

- Development of Trading Algorithms: By leveraging programming skills, professionals can create algorithms that analyze stock market trends and predict IPO performance, allowing for data-driven investment decisions.

- Financial Data Analysis: Using platforms like Groww and Angel One, developers can build applications that aggregate and analyze financial data, providing insights into market dynamics.

- NPA Management Tools: The banking sector’s need for effective NPA management can inspire tech professionals to develop tools that utilize machine learning for predictive analytics, helping banks mitigate risks.

Learning Path Recommendations

To navigate the complexities of the IPO market and the banking sector, consider the following learning paths:

- Financial Analysis Courses: Enhance your understanding of financial statements, ratios, and market evaluation techniques. Platforms like Coursera and Udemy offer courses tailored to investing and financial analysis.

- Stock Market Evaluation: Learning about market trends and stock valuation techniques is crucial. Look for specialized courses that cover asset valuation and investment strategies.

- Trading Strategies: Familiarize yourself with pre-open trading mechanisms and their effectiveness through online resources and webinars. Understanding market timing can significantly impact investment outcomes.

Industry Impact and Career Implications

The growth of the IPO market in India not only shapes investment strategies but also creates a demand for skilled professionals who can navigate this landscape. As businesses seek to innovate and leverage technology, the following career implications arise:

- Increased Demand for Financial Analysts: With the rise of IPOs, companies require experts who can assess their financial health and market potential.

- Opportunities in Fintech: The integration of technology in finance has led to the emergence of fintech companies, creating roles for developers skilled in finance-related applications.

- Stock Market Advisors: As investors seek guidance, there’s a growing need for advisors who understand both the technical and financial aspects of the market.

Implementation Tips and Best Practices

When venturing into the IPO market or improving NPA management, consider these implementation tips:

- Leverage Technology: Utilize trading platforms like IIFL Capital and Nuvama for real-time data and analytics. These tools can streamline your investment decision-making process.

- Stay Informed: Regularly follow financial news and market trends. Understanding current events and regulatory changes can provide a competitive edge in investment strategies.

- Network with Professionals: Engage with industry experts through webinars, conferences, and online forums. Networking can lead to valuable insights and career opportunities.

Future Trends and Skill Requirements

As the financial landscape evolves, technology will play an increasingly crucial role. Here are some trends to watch for:

- AI and Machine Learning in Finance: The integration of AI in trading and NPA management is set to grow, making skills in machine learning essential for tech professionals.

- Increased Regulation and Compliance: As the IPO market expands, so will regulatory scrutiny. Professionals must stay abreast of compliance requirements and regulatory frameworks.

- Remote Trading and Investment Platforms: The rise of digital trading platforms will continue to democratize access to markets, necessitating knowledge of various online tools and services.

Conclusion with Actionable Next Steps

As a tech professional, staying ahead in the investment landscape requires a blend of programming skills and financial acumen. Here are actionable steps to take:

- Enroll in financial analysis and stock market courses to build foundational knowledge.

- Experiment with trading algorithms and financial data analysis using platforms like Groww and Nuvama.

- Join communities that focus on finance and tech to expand your network and learn from others in the field.

By embracing these learning opportunities and staying informed about industry trends, you can position yourself for success in an ever-evolving financial ecosystem. Whether you’re developing innovative tools or analyzing market trends, your skills can significantly impact investment strategies and contribute to the financial sector’s future.

Disclaimer: The information in this article has been gathered from various reputed sources in the public domain. While we strive for accuracy, readers are advised to verify information independently and consult with professionals for specific technical implementations.

Ready to advance your tech career? Explore our digital learning resources including programming guides, certification prep materials, and productivity tools designed by industry experts.